Ignoring it will hurt your pocket:

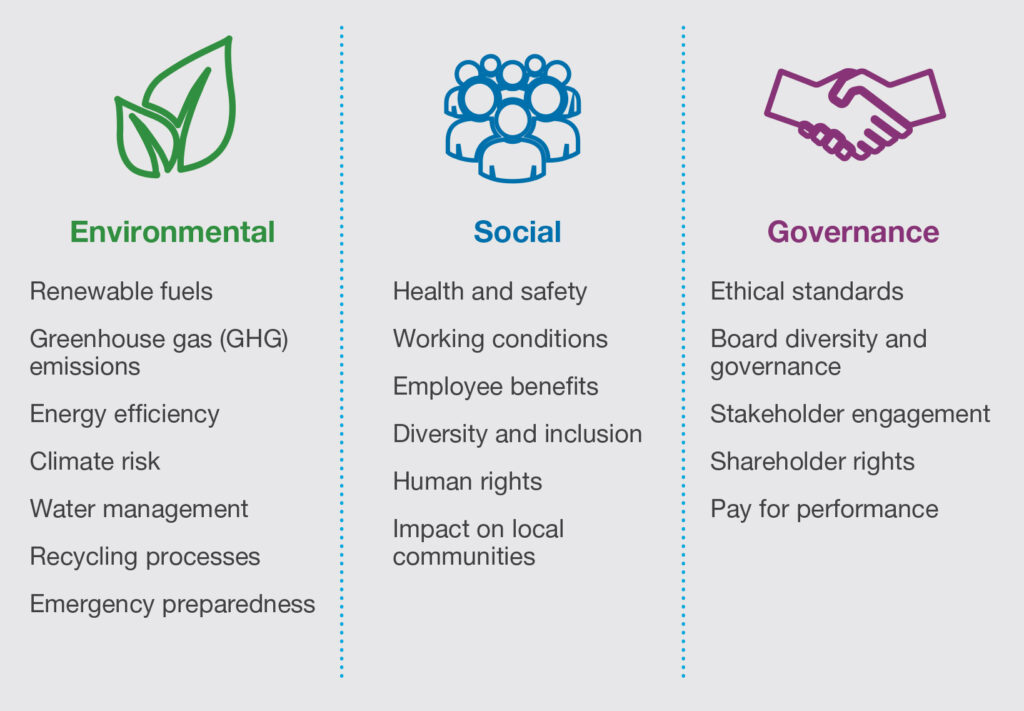

Environmental, Social and Governance (ESG) value drivers first emerged from a UN conference in 2005. Over time it has become an important filter for investors and employees. But what is it exactly and who does it apply to? What are the consequences of ignoring it? This post sets the scene and helps you act.

A bit of history

There has been a long battle since Adam Smith between ‘blind profit’ objectives and running a responsible business. Recent iterations have included the Capital Asset Pricing Model (1960s) which evolved into concepts of value creation/destruction and an orthodoxy about how to run businesses based on hard corporate finance principles. This went largely unchallenged until the financial meltdown of 2008. Since then, there have been numerous attempts to redefine capitalism (‘stakeholder centric’), creating ecologically sustainable practices throughout the supply chain and, since the pandemic, questioning the wisdom of long distance travel for manufactured goods – let alone executive travel…

What is ESG?

ESG reporting has become a mainstream requirement for listed companies: it covers a variety of topics from resources use, human rights, health and safety, corruption and transparency. Originally it was limited to specialist ethical funds: fund managers would only invest in those listed companies with good ESG reporting. It has evolved to now cover all listed businesses. It will soon cover most medium sized businesses including unlisted/family owned down to 250 employees.

Is ESG the new CSR?

Corporate Social Responsibility is a general model (i.e. unregulated) where companies present themselves as socially accountable to all stakeholders. It helps the company to both have a social impact and improve its image to the public and employees. Because of its unregulated nature, there has a considerable amount of ‘CSR-washing’ with companies taking token action at home while keeping a blind eye on their supply chain for example. ESG is more regulated, even if a clear standard has yet to emerge.

Pushed by investors and Governments

Another key difference between ESG and CSR is that ESG has become a requirement for fund managers and covers all asset classes: shares, bonds, private equity… Governments are pushing for this too, with the UK adopting both EU and OECD requirements. Perhaps a better analogy for ESG is Socially Responsible Investment (SRI), a precursor which screened out those companies that operated in certain industries (e.g. tobacco, military equipment) or countries (e.g. apartheid South Africa).

Burden of the proof is with the business

Every company falling under the remit of ESG must report on it yearly (normally as part of their annual report if listed). They need to indicate both where they are in each area but also how they intend to do to improve. If the answers are absent or unsatisfactory, they may be rejected by investors and regulators.

It’s complicated to get it right

Reporting on ESG is a bit like playing 3D chess: you need to decide which law applies to your business, which reporting framework to adopt, the level of depth of reporting for each category, how categories influence each other and who will help you to improve performance.

A jungle of rules and frameworks

There are two schools of thought: formal reporting (e.g. ISO 140010 for environmental reporting) or ‘framework’ reporting (e.g. the UN Global Compact). In Europe the most widely used is the Global Reporting Initiative (GRI). Another is the FTSE Russell ESG rating model – used to rate investments for inclusion in indices. In addition some industry bodies are doing their own thing (e.g. Lloyd’s insurance market).

To make things worse these frameworks then cross with local initiatives. For instance in the UK the various Diversity and Inclusion (D&I) frameworks and the legal requirement to report on the Gender Pay Gap.

Far beyond Environmental reporting

Many companies have tackled their carbon footprint first as well as labour conditions in their supply chain. They have not worried about the mental health of their UK employees, their tax transparency, their community impact or managing people risk. The FTSE framework contains 300 indicators with an average of 125 applied per company!

Make early choices, refine later

The first thing to do is to choose which components of the reporting are relevant to you today or will be in the next couple of years. Then decide which indicators you want to supply and where. We suggest that ESG reports into the CFO, even if a lot of information needs to be supplied by HR, Legal, Operations or Supply Chain. In each case, think about what you already have (Learning and development activities, anti modern slavery monitoring, tax reporting…) and investigate the gaps with best practice. Then decide who will own which topic both in terms of reporting and improvement. Get it wrong early so that you can improve it the following year: this is a messy business and you may need outside help in various areas.

Conclusion: pay attention now or pay later

The cost of being seen as slack in this area (ESG-washing?) falls into four categories:

- For listed companies, being rejected by fund managers will have a direct impact on the valuation of the business as well as the cost of capital. ESG accounts for over 70% of all assets under management in Europe. You don’t want to be left out.

- ESG has a strong brand impact: in each sector customers, employees and investors carry out peer comparisons:: being the ugly ESG duckling will hurt your attractiveness to all stakeholders (and your share price if listed).

- Short term performance: companies with lower environmental standards pay more fines; companies with unhappy employees incur more absenteeism and disrupted production. Customers are prepared to pay a modest price premium for ethical, true-green companies’ products

- Long term performance. To quote Larry Fink, CEO of investment giant Blackrock: “The more your company can show its purpose in delivering value to its customers, its employees, and its communities, the better able you will be to compete and deliver long-term, durable profits for shareholders.”

So it’s worth paying attention to ESG. Each case is different. Contact us to discuss yours.